As discussed in the following article on RealEstate by Aleisha Dawson, the Gold Coast property market has shown resilience and growth in recent times - https://www.realestate.com.au/news/hot-property-market-explosive-population-growth-driving-real-estate/.

On that note we will do a quick property market review of the suburbs of Gold Coast. We have picked 4 affordable suburbs in the Gold Coast, and reviewed key data for Houses.

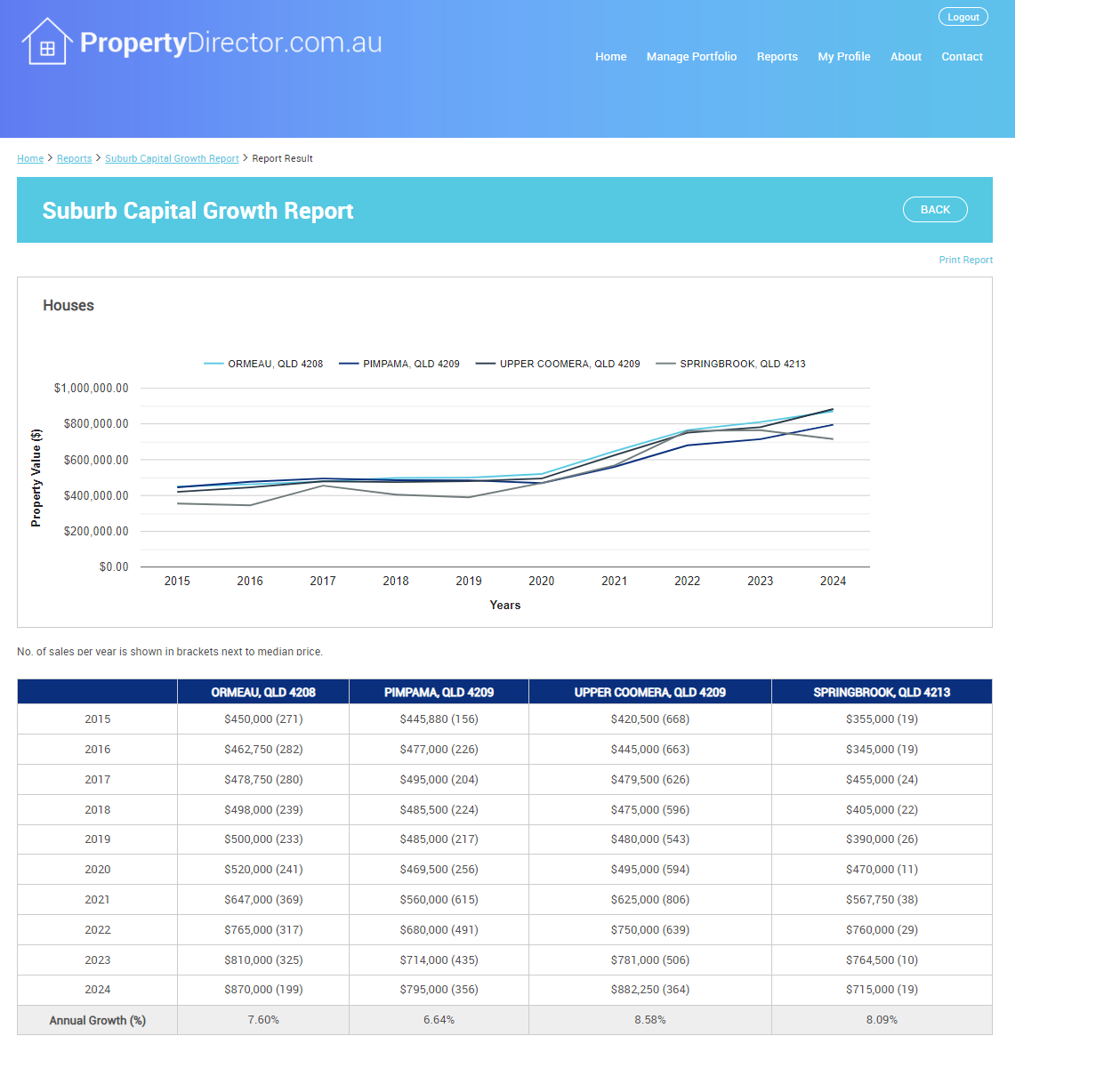

Ormeau, QLD 4208

- median price is $870,000 (annual capital growth of 7.6% annually during last 10 years - prices almost doubled).

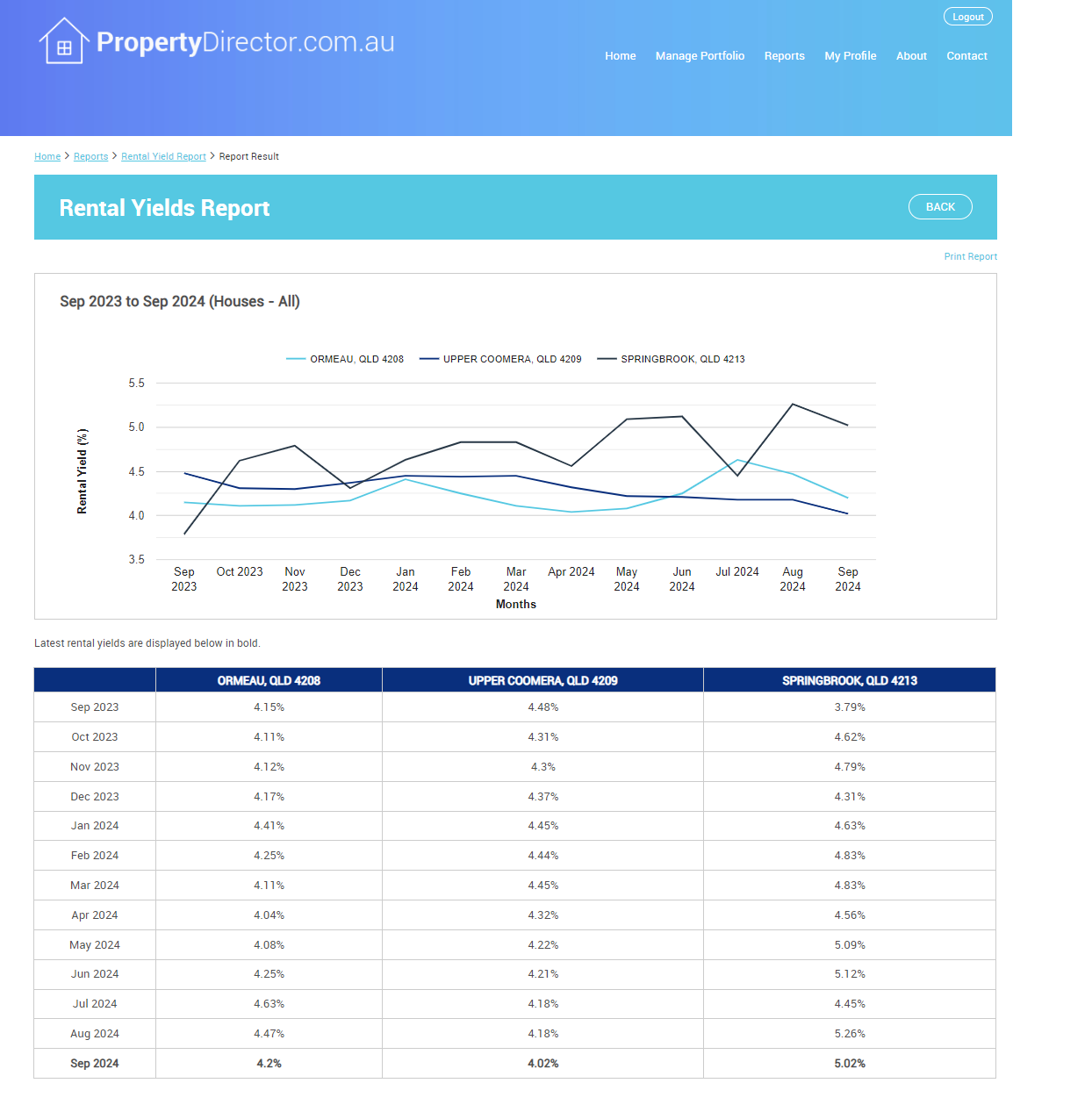

- rental yield is 4.2% (reasonable rental yield for investors)

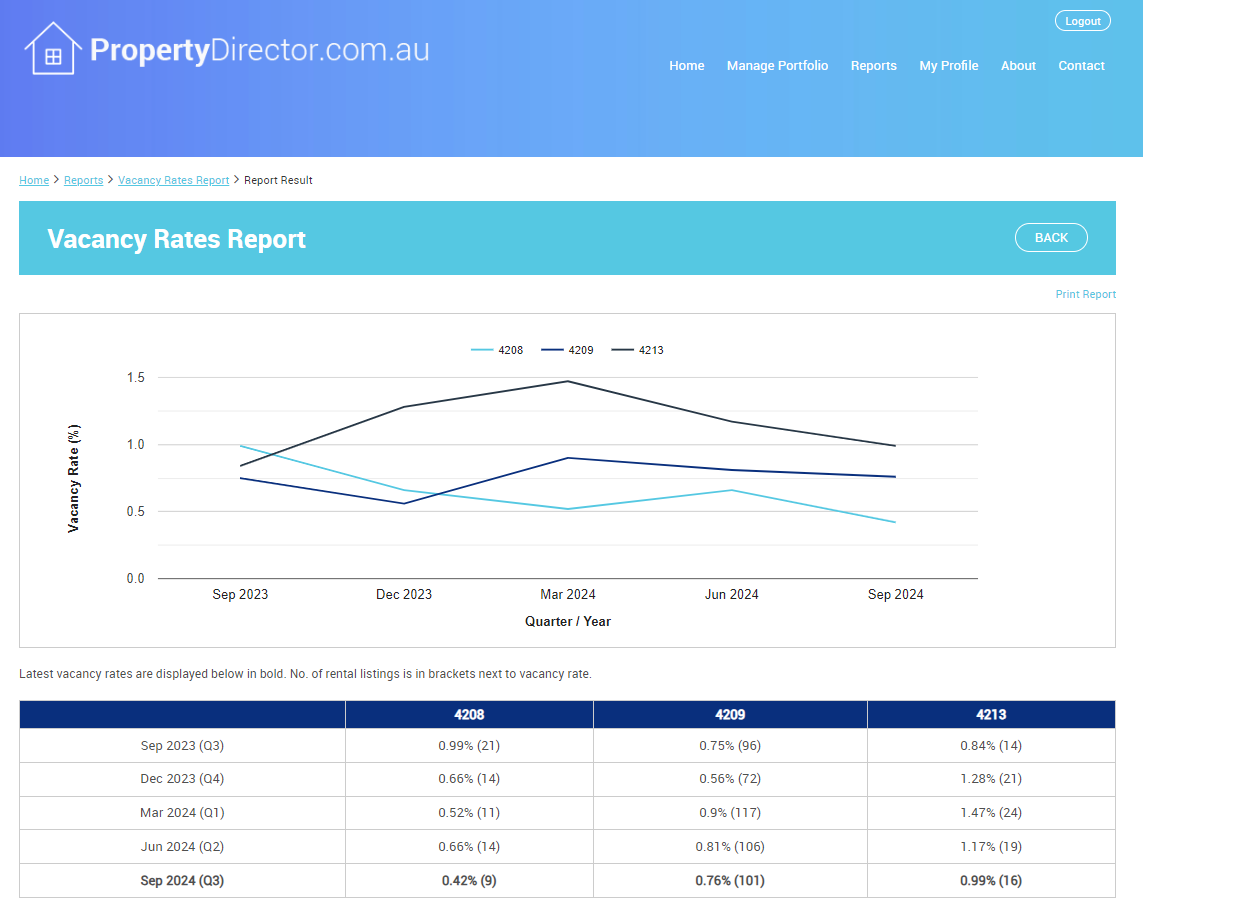

- vacancy rate is 0.42% (nice tight rental market for landlords)

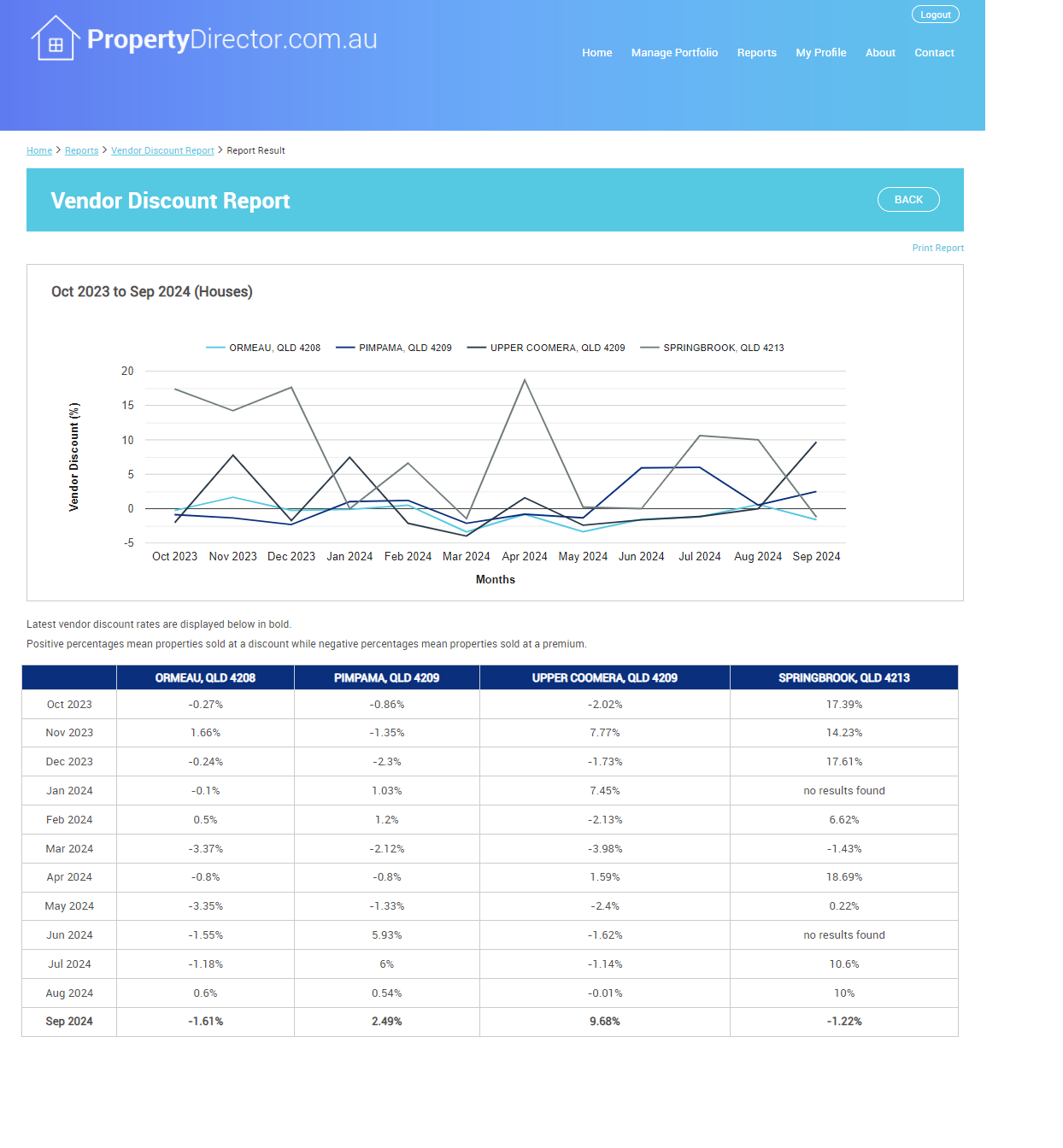

- vendor discount rate is -1.61% (properties are selling at 1.61% above listed sales prices)

- days on market is 55 (properties are taking 55 days to sell, which reasonably good for sellers)

Pimpama, QLD 4209

- median price is $795,000 (annual capital growth of 6.64% annually during last 10 years).

- rental yield is 4.02% (reasonable rental yield for investors)

- vacancy rate is 0.76% (nice tight rental market for landlords)

- vendor discount rate is 2.49% (properties are selling at a discount of 2.49% relative to listed sales prices)

- days on market is 51 (properties are taking 51 days to sell, quick is reasonably good for sellers)

Upper Coomera, QLD 4209

- median price is $882,250 (annual capital growth of 8.58% annually during last 10 years - prices MORE THAN DOUBLED).

- rental yield is 4.02% (reasonable rental yield for investors)

- vacancy rate is 0.76% (nice tight rental market for landlords)

- vendor discount rate is 9.68% (properties are selling at a discount of 9.68% relative to listed sales prices)

- days on market is 64 (properties are taking 51 64 to sell, which is quite reasonable for sellers)

Springbrook, QLD 4213

- median price is $713,000 (annual capital growth of 8.09% annually during last 10 years - prices MORE THAN DOUBLED).

- rental yield is 5.02% (a good solid rental yield for investors)

- vacancy rate is 0.99% (nice tight rental market for landlords)

- vendor discount rate is -1.22% (properties are selling at 1.22% above listed sales prices)

- days on market is 165 (properties are taking 165 days to sell, meaning it is taking a while to sell property in this area)

In summary, property in these 4 Gold Coast suburbs have done very well over this period. Upper Coomera has seen the most significant capital growth, and Springbrook tends to provide the best value for money according to the vendor discount rates.

This is just the tip of the iceberg - to gain these suburb insight plus further detailed demographic information and additional valuable data points to inform your best investment decisions, go to https://www.propertydirector.com.au/choose-plan and subscribe to our Professional plan now for $49 a month.