With investors maintaining a keen eye on the Victorian property market, there is sentiment across the board that Victoria is the state poised for growth in the coming 12 months.

As the following article by Craig Francis from Australian Property Investor (API) describes, Victoria's prices have fell behind in recent times, and being Australia's most livable city with a growing population, it has a lot going for it - https://www.apimagazine.com.au/news/article/investors-warming-to-victoria-but-is-the-sentiment-justified.

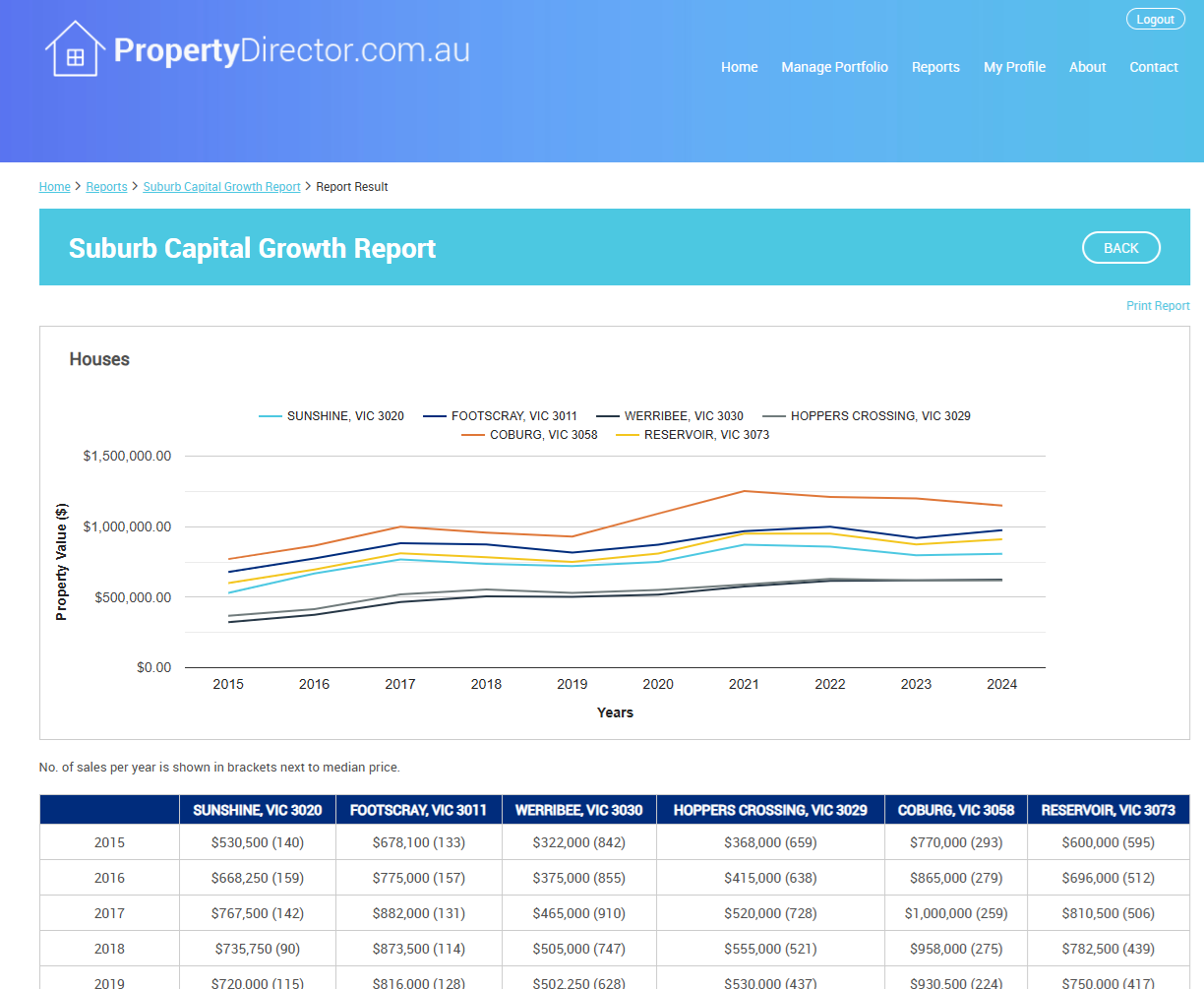

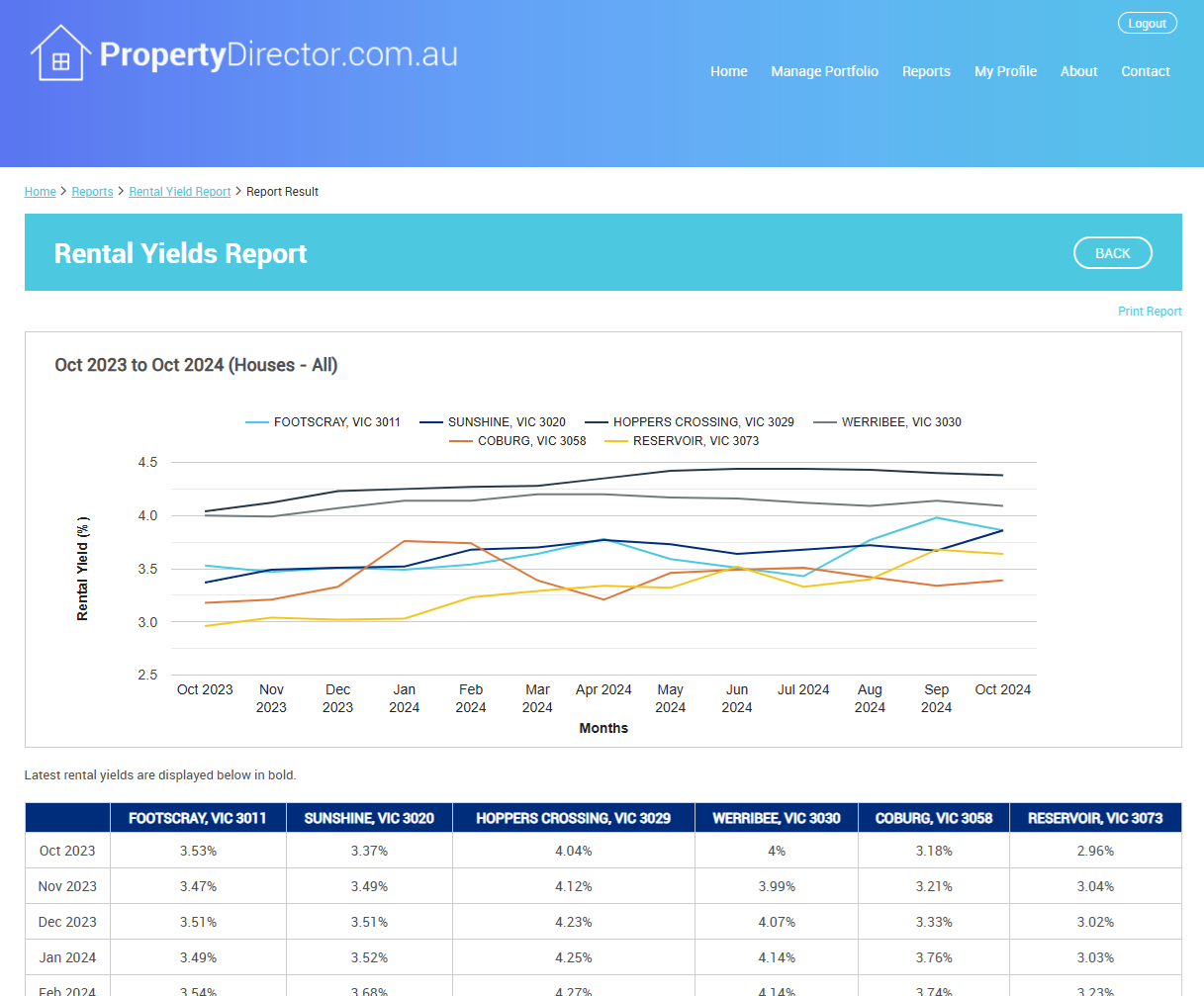

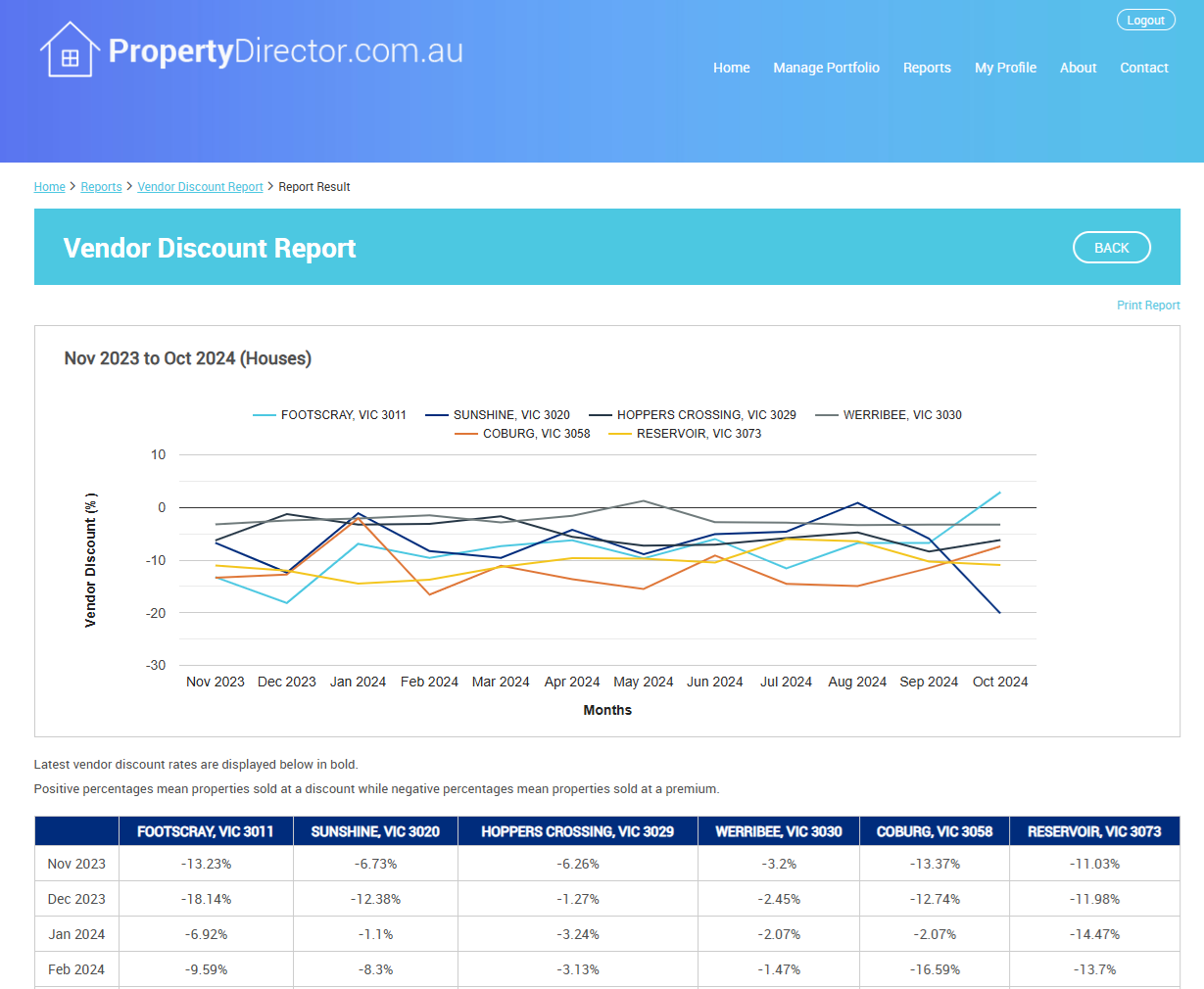

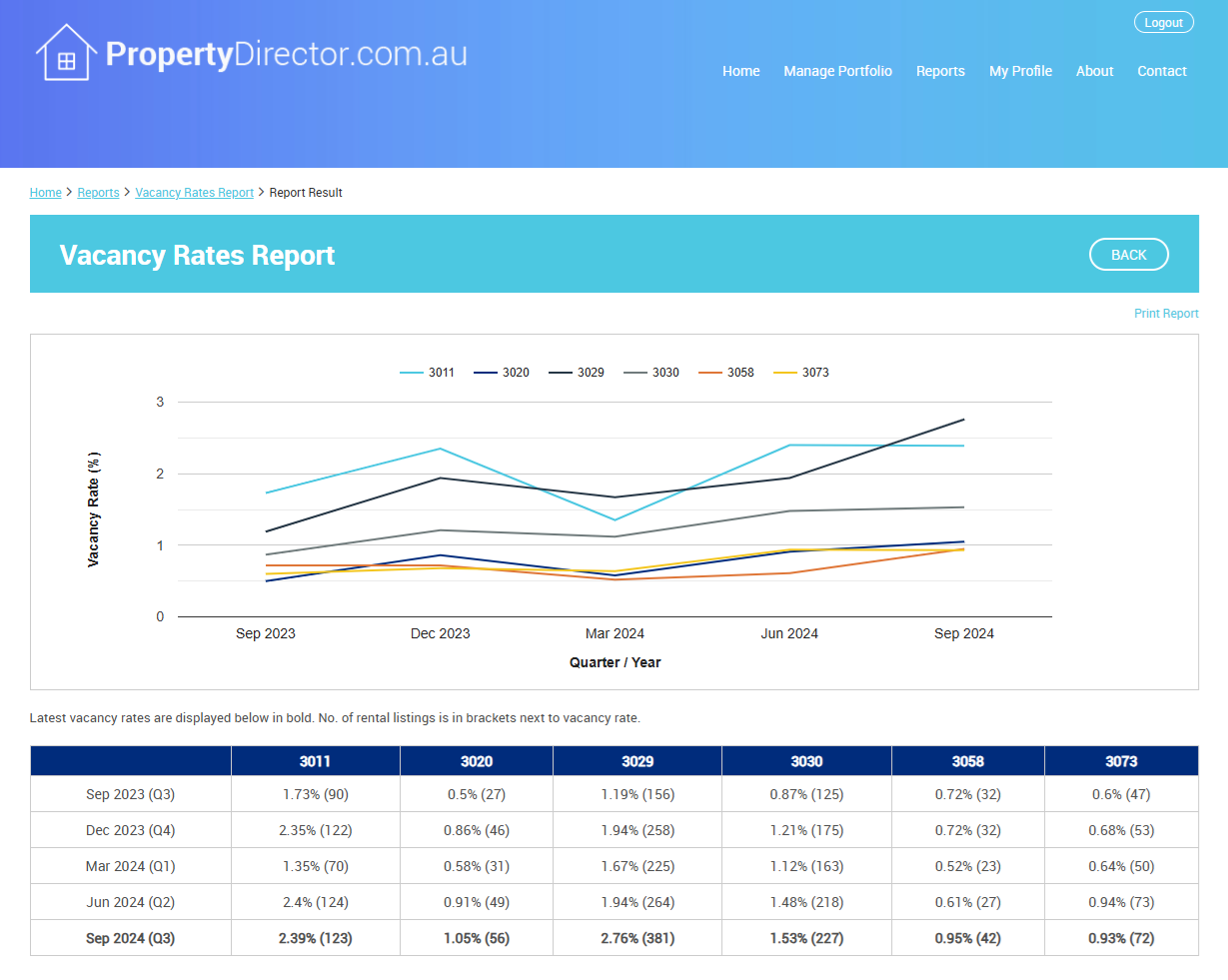

The article lists key suburbs with major city infrastructure projects underway, including Sunshine, Footscray, Werribee, Hoppers Crossing, Coburg, and Reservoir. All are fairly affordable suburb options in the current market.

On that note we have analysed all 6 suburbs using the suburb capital growth report, vacancy rate report, rental yield report, and vendor discount report. You can see all 4 reports below with data for the 6 suburbs shown simultaneously.

Key observations:

Median prices for all suburbs are currently below $1 million (excluding Coburg)

3 out of the 6 suburbs (Sunshine, Coburg, Reservoir) grew less than 5% annually during the last 10 years.

Rental yields for 2 out of 6 suburbs (Hoppers Crossing and Werribee) are above 4%, with the remaining suburbs between 3-4% rental yields.

Vacancy rates for Coburg and Reservoir are below 1%.

Vendor discount rates for all suburbs (except one) show that properties in these suburbs are selling at premiums (above originally listed prices), indicating that we are already seeing buyer demand in these locations.

To gain access to these great data insights, register to PropertyDirector's Professional plan today by going here - https://www.propertydirector.com.au/choose-plan.